Welcome to Based.Farm, the first Solidly powered Seigniorage Protocol, now with an exciting Casino and Sportsbook experience!

Seigniorage will be the engine that scales Ethereum liquidity on Base Chain. Traditionally based on monetary supply, seigniorage controls token value with measured inflation and deflation. Based.Farm improves this and liquidity conditions on Base Chain, while also maximizing efficiency using Solidly (AerodromeFi (opens in a new tab)).

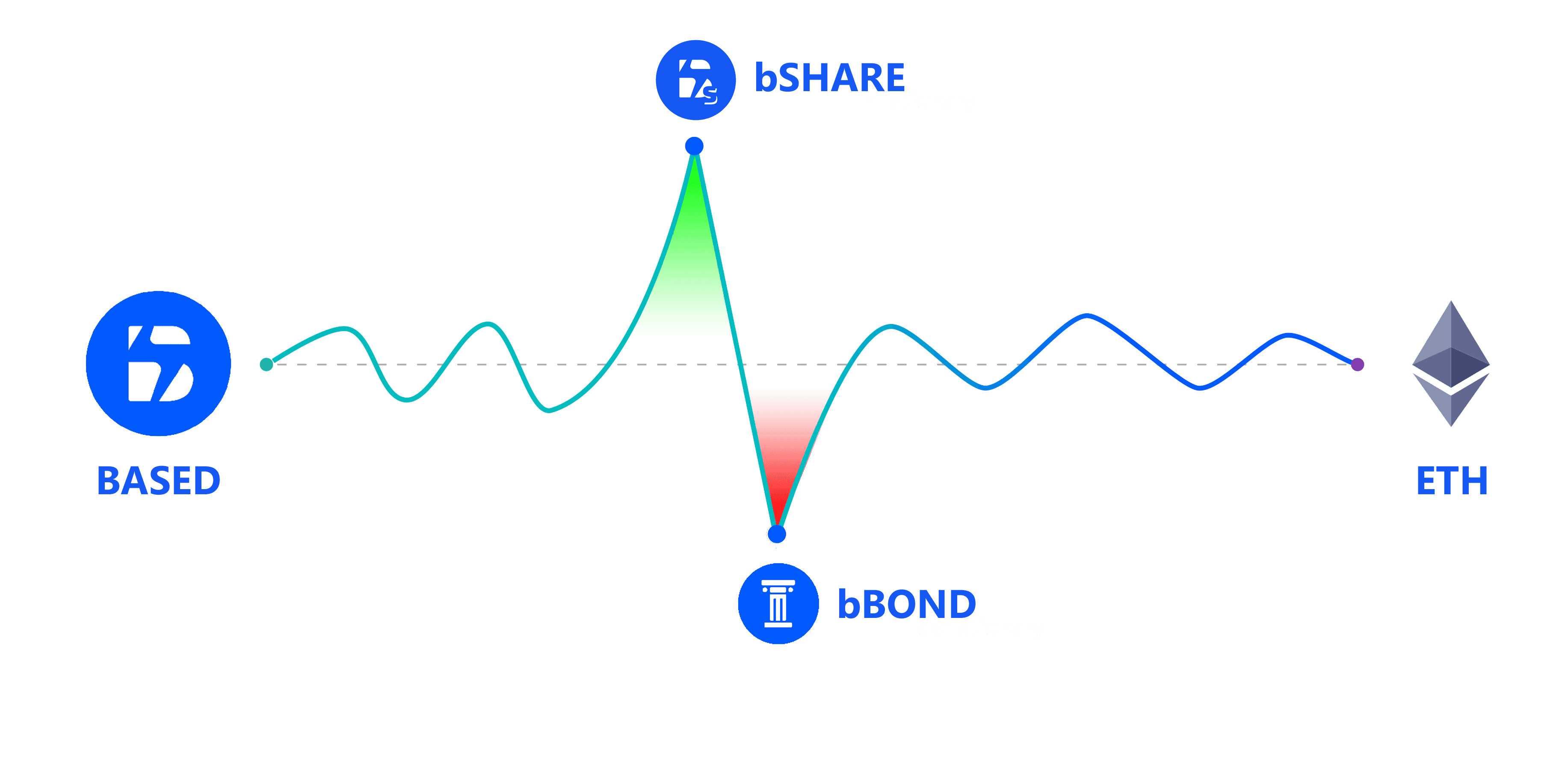

- BASED (opens in a new tab) - Pegged 1:1 with Ethereum.

- bSHARE (opens in a new tab) - Rewarded newly emitted BASED for staking.

- bBOND (opens in a new tab) - Burns excess BASED for stability.

The Mechanism of SEIGNIORAGE

When BASED rises above Ethereum, new tokens are minted, rewarding those with bSHARE staked. This naturally increases the supply, nudging the token's value closer to its peg. On the flip side, should BASED drop below its peg, minting halts, creating a deflationary phase. During this phase, holders can opt to trade BASED for bBOND, effectively decreasing the total supply and gradually elevating the price.

At Based.Farm, every piece of the puzzle is meticulously designed to ensure the harmonious flow of BASED. The inflation and deflation described above is controlled by The Forge (opens in a new tab), The Warden (opens in a new tab), and Bonds (opens in a new tab). These mechanisms dynamically adjust BASED supply, pushing price up or down relative to Ethereum.

- The Armory (opens in a new tab) - Liquidity ensures protocol health and longevity.

- The Forge (opens in a new tab) - Controls BASED inflation during periods of high-demand.

- The Warden (opens in a new tab) - Stabilizes price during volatility.

- Bonds (opens in a new tab) - Burns BASED supply.

sAMM Advantage

This graph depicts the swap curves of stable (blue) and volatile (red) automated market markers, the flatter the curve, the lower the slippage. For asset pools pegged 1:1, stable AMMs are more reliable.

sAMM (blue) and vAMM (red) Swap Curves

Seigniorage protocols have a singular mission - keeping their main asset pegged to its target value. With BASED being pegged 1:1 with Ethereum, AerodromeFi (opens in a new tab) sAMM pools are a no-brainer. Traditional AMMs can intensify volatility; sAMM increases depth (amount you can buy), allowing consistent outputs. This creates minimal slippage, allowing even large trades to maintain liquidity equilibrium. For asset pools like BASED-ETH, this is key. Without getting too deep into the formulas, sAMM keeps total pool liquidity consistent, regardless of trade volume and market fluctuation.

The essence of Based.Farm lies in individual choices, with inflation and deflation built on emissions, voting gauges, and bribes. With incentives strategically placed, each participant has the freedom to optimize their yield, providing opportunities in every scenario.

Your strategy is your strength. Finding the right mix between BASED (opens in a new tab), bSHARE (opens in a new tab), and bBOND (opens in a new tab) is the key to maximizing your time at Based.Farm.